China’s Economy in Crisis: A Bleak Outlook for 2024

China’s Economy in Crisis: A Bleak Outlook for 2024

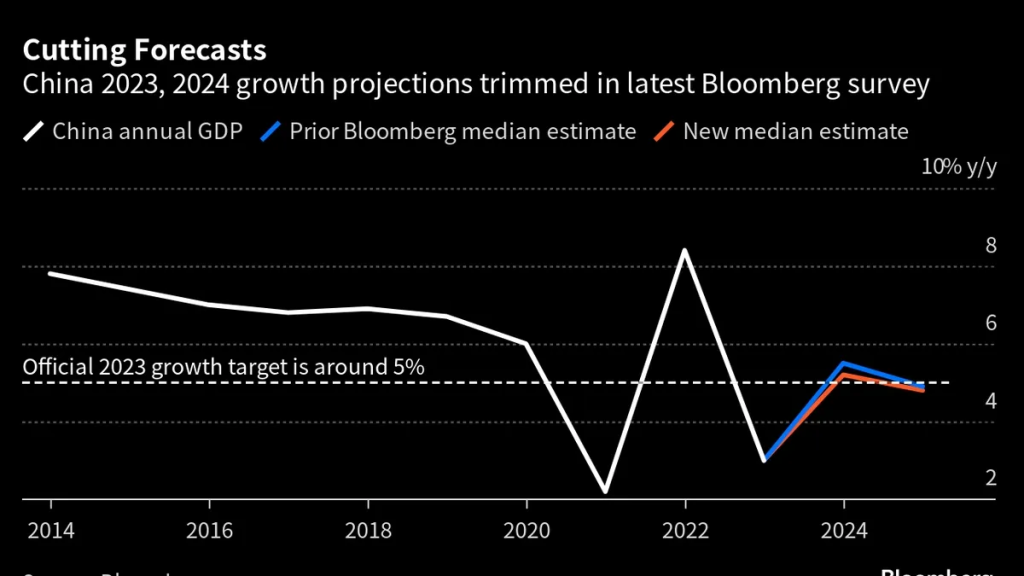

China’s economy, once a global growth engine, has hit a major roadblock. The International Monetary Fund (IMF) and other experts now consider it a “drag” on the world’s output. Despite efforts to overcome challenges such as a property crisis, weak spending, and high youth unemployment, the Chinese economy is struggling to recover its pre-pandemic growth levels. While it is expected to achieve its official growth target of around 5% this year, it falls short of the 6%-plus annual growth seen in the previous decade. The outlook for 2024 and beyond appears increasingly grim, with the possibility of decades of stagnation looming.

The Middle Income Trap: A Dire Warning

Economists are raising concerns that without significant market reforms, China may fall into what is known as the “Middle Income Trap.” This concept refers to emerging economies that experience rapid growth, only to become stuck in a middle-income bracket before achieving high-income status. Derek Scissors, a senior fellow at the American Enterprise Institute, emphasizes that while GDP growth is expected to exceed 4.5% in 2024, the only direction from there is downward. Structural changes are needed to avoid this trap and secure a sustainable growth trajectory.

From Rapid Growth to Slowing Expansion

China’s remarkable economic growth since opening up to the world in 1978 has been a defining feature of its development. Between 1991 and 2011, the country experienced an average annual growth rate of 10.5%. However, under the leadership of President Xi Jinping, growth began to slow. Despite still averaging 6.7% in the decade leading up to 2021, the expansion trend faced headwinds. The troubled real estate sector, coupled with demographic decline, contributed to the deceleration.

Structural Challenges and Policy Missteps

The Chinese economy did not find itself in this predicament overnight. During the global financial crisis in 2009, President Hu Jintao’s administration injected liquidity into the economy to stimulate growth. However, President Xi’s government, which took office in 2012, hesitated to rein in borrowing, leading to the accumulation of structural problems. Logan Wright, director of China markets research at Rhodium Group, suggests that the slowdown is rooted in the end of an unprecedented credit and investment expansion over the past decade.

Additionally, Beijing’s strict zero-Covid policy, characterized by stringent lockdowns, and its crackdown on private enterprise have damaged confidence and negatively impacted the economy. The consequences of these policies are evident in the sluggish demand, deflationary risks, and the deepening real estate crisis. Home sales have plummeted, pushing even healthy developers like Country Garden to the brink of collapse. The crisis has also affected the massive shadow banking sector, leading to defaults and nationwide protests.

Local governments are grappling with financial difficulties after years of Covid-related spending and declining land sales, resulting in reduced services and benefits for the population. Moreover, foreign companies are becoming wary of Beijing’s increased scrutiny and are withdrawing from the Chinese market. Foreign direct investment (FDI) turned negative for the first time in over two decades, according to data from the third quarter. The American Chamber of Commerce in Shanghai’s survey revealed a historically low level of optimism among respondents about their five-year business outlook.

A Comparison to Japan’s Lost Decades

As China’s growth slows, economists draw comparisons to Japan’s experience with two “lost decades” of stagnant growth and deflation following its real estate bubble burst in the early 1990s. However, Scissors believes that China’s trajectory will differ, at least in the immediate future. He predicts that Chinese GDP growth will remain above zero in the coming years. Nevertheless, the most significant economic challenge lies in demographics. China’s population witnessed its first decline since 1961, reaching 1.411 billion in 2023. The total fertility rate, a crucial factor in population growth, dropped to a record low of 1.09. These demographics, coupled with a decline in labor supply and increased healthcare and social spending, pose substantial risks. A smaller workforce may lead to a wider fiscal deficit and higher debt burden. Eroded savings could result in higher interest rates and declining investment. The long-term impact on housing demand is also a concern. Scissors warns that population contraction in the 2040s will make aggregate growth impossible without significant policy changes.

A Glimpse into China’s Future

China’s leadership acknowledges the challenges and plans to increase fiscal and monetary support for the economy. They aim to boost confidence through strengthened “economic propaganda” and “public opinion guidance.” However, these measures are unlikely to address the underlying structural issues. Julian Evans-Pritchard, head of China Economics at Capital Economics, cautions that China’s slowdown is primarily due to a structural decline in productivity and income growth. Demand-side stimulus or confidence-boosting measures may provide short-term relief but won’t reverse the overall trend.

If Beijing resorts to its old playbook by increasing borrowing, it may temporarily spur growth in 2024. However, this would serve as a mere “pain-killer” rather than a cure. To avoid a bleak future, China must embrace substantial market reforms and address the challenges posed by demographic shifts. The official growth target for next year is expected to be set around 5%, reflecting an ambitious goal compared to independent forecasts. However, achieving this target will require more than optimistic projections; it necessitates an overhaul of the economic system to ensure sustainable growth and avoid the pitfalls of a middle-income trap.

Conclusion

China’s economy faces an uphill battle as it struggles to regain its pre-pandemic growth levels. Structural challenges, policy missteps, and demographic shifts have combined to create a bleak outlook for 2024 and beyond. While short-term measures such as fiscal and monetary support may offer temporary relief, long-term solutions are needed to avoid a prolonged period of stagnation. China must learn from its past and undertake significant market reforms to secure a sustainable growth trajectory. The coming years will be critical in determining whether China can overcome these challenges and continue its journey as a global economic powerhouse.